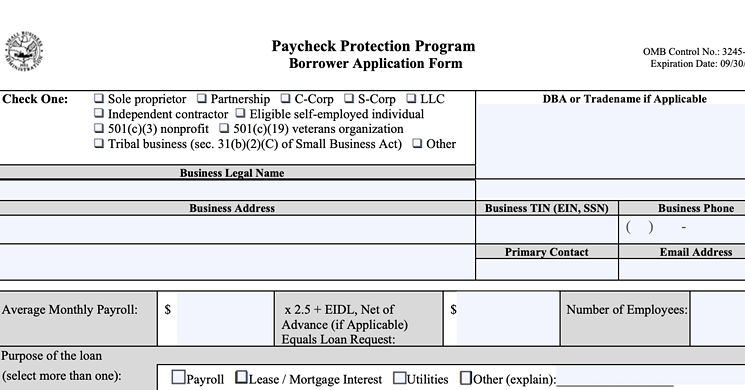

Did you apply to get part of the $350 billion being given out to businesses as part of the Paycheck Protection Program? Rather -- did you attempt to?

In the most unsurprising fashion, the amount of traffic trying to get through to apply crashed websites and tied up telephone wires (if they even use wires anymore.) To call it chaotic would be an understatement.

In his annual letter to stockholders, JP Morgan Chase CEO Jamie Dimon told investors that, “JPMorgan Chase Institute research reveals that 50% of small businesses have less than 15 cash buffer days, reinforcing why small businesses are being heavily disrupted by the current crisis and will feel the effects for a significant period of time – even as more capital from the recent federal stimulus program reaches them.”

This exacerbates just how critical it is to get the money provided by federal stimulus programs to small-to-medium-sized businesses.

While the launch of the program itself was a mess, business owners have started to criticize what they see as a deeply-flawed program.

Because the loan is meant to retain worker employment, several businesses, such as those whose operating costs far outweigh their payroll costs, are having a tough time figuring out how it actually helps them.

According to Bloomberg, funds from the program were expected to dry out last Wednesday afternoon, with more than 1.4 million applications approved.

Congress is acting (as fast as bureaucracy allows them to) to get additional funds for furthering the Paycheck Protection Program as well as other small business loans and stimulus packages.

Keep a look-out on our LinkedIn and Facebook pages for updates.